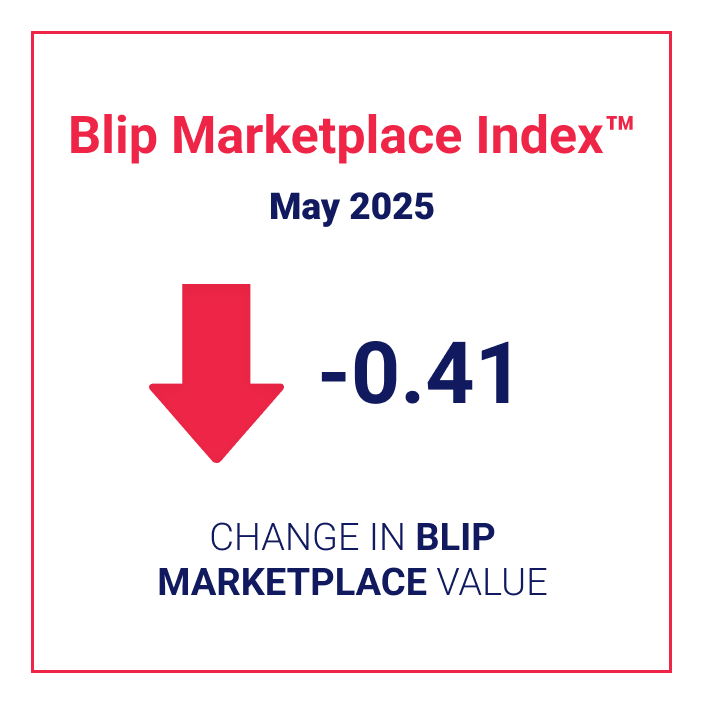

The Blip Marketplace Index

How business owners make smarter investments

The Blip Marketplace Index (BMI) is a proprietary index reflecting purchasing trends and sentiment on Blip’s out-of-home marketplace derived from millions of data points across approximately 20,000 SMB advertising budgets.

If you sell into SMB businesses, the Blip Marketplace Index can give you, investors, and others insight into:

SMB market sentiment including optimism, pessimism, risk tolerance, and aversion

Purchasing power: budget availability and cost of capital

Broad prices charged to customers and paid to suppliers